Optimizing Insurance Operations with Salesforce

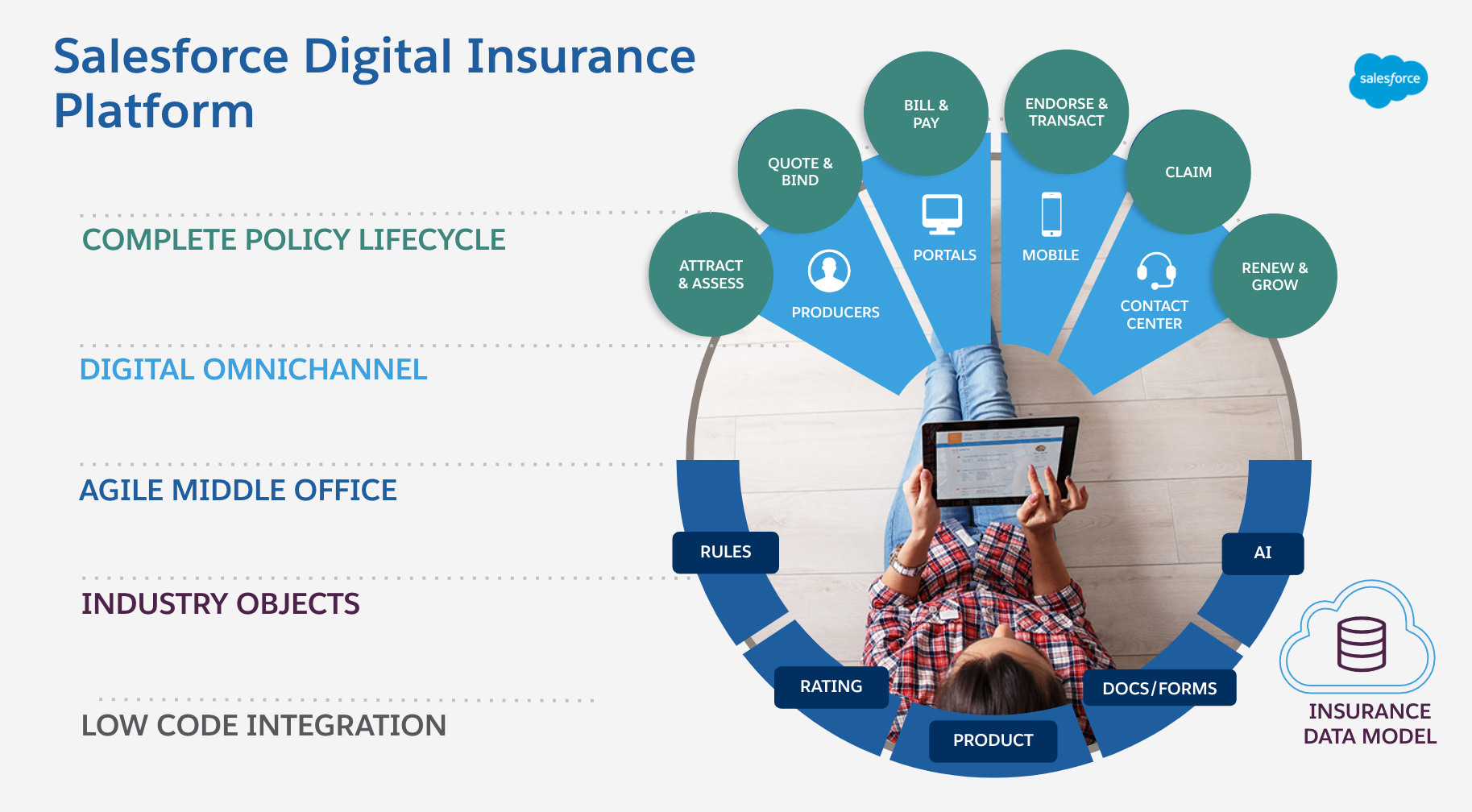

The insurance industry is increasingly focused on delivering personalized and integrated customer experiences, while streamlining backend operations. Leveraging Salesforce, insurance companies can automate processes, improve risk management, and boost operational efficiency. Salesforce’s cloud-based solutions provide a comprehensive platform for managing customer relationships, automating marketing, and integrating legacy systems, making it a powerful tool for insurers, brokers, and agencies alike. PracticeVantage has been at the forefront of helping insurance companies fully utilize Salesforce to meet these industry demands.

By using Salesforce, insurance companies can streamline their operations and provide customers with more personalized experiences. At the same time, legacy systems do not need to be replaced or manually migrated; Salesforce’s powerful integration tools allow businesses to modernize without interrupting their existing workflows. Additionally, by harnessing Salesforce’s predictive analytics capabilities, insurers can turn vast amounts of data into actionable insights that improve decision-making across the organization.

PracticeVantage’s expertise in Salesforce for Insurance

PracticeVantage has extensive experience helping insurance companies, including agencies, brokers, and carriers, implement and optimize Salesforce solutions. Our team understands the unique challenges of the insurance industry and tailors Salesforce customizations to meet the specific business needs of each client. From enhancing marketing automation to integrating with legacy systems, we ensure that insurers can maximize their Salesforce investments.

- Industry-Specific Customization: We customize Salesforce solutions to reflect the unique needs of insurers, from risk management to claims processing.

- Comprehensive Data Integration: Our expertise ensures seamless data integration between Salesforce and existing legacy systems, unlocking valuable insights without disrupting operations.

The insurance industry is undergoing rapid transformation, with increasing demands for better customer experiences and more efficient backend operations. By partnering with PracticeVantage, insurers can leverage the full power of Salesforce to streamline their processes, integrate data from legacy systems, and improve customer engagement. As the industry continues to evolve, PracticeVantage ensures that insurers remain agile and ahead of the curve with their Salesforce solutions.